Noli Studios

Flexible living for modern urbanites

Real estate plays a crucial role in our urban lives – buildings are where we live, work and play.

Accelerating urbanization calls for an immense effort to create new buildings and optimize real estate. More importantly, it is crucial we do it right.

Because with cities’ evolving skylines come towering problems. Real estate accounts for 37 % of global carbon emissions and is putting future generations at risk. And it’s often seen as simply an asset, ignoring the real needs of people who actually use buildings.

Our deep knowledge curve and scaling solutions enable us to identify areas where we can make the most significant impact.

The Nrep Delivery Model is Nrep’s framework developed to future-proof our investments. It encompasses our sustainability purpose and vision translated into defined targets, providing clear guidance and methodologies that support decision making from screening through the entire asset ownership period and exit.

The key component of Nrep’s delivery model focuses on climate change in line with our science-based emission reduction targets and dedication to minimize transitional and physical climate risks. In addition, Nrep’s Delivery Model sets out a holistic framework, additionally focusing on e.g., circularity, supply chain, business conduct and positive impacts on people, whether that being our suppliers, tenants or the communities in which we operate.

Our Delivery model consists of three overarching tools and frameworks:

– Sustainable Due Diligence (SDD): Our SDD framework guides the mandatory sustainability analysis for investment cases, which are presented to the Investment Committee. It includes a detailed assessment of sustainability risks and value creation opportunities.

– Sustainable Development Performance Standard (SDPS): For new builds and retrofits, SDPS ensures projects live up to Nrep’s requirements related to decarbonization, certifications and further sustainability targets. Design needs to be aligned with the leading holistic sustainability and environmental certification schemes, rated LEED Gold, BREEAM Very Good or DGNB Gold certified at minimum and have design-stage life cycle assessment (LCA) in place.

– Sustainable Action Plans Standing Assets (SAPSA). SAPSA ensures Nrep’s standing assets undergo transformation and sustainability improvements during ownership

We urgently need better ways to construct and operate buildings. Nrep is committed to lead and accelerate the way towards a carbon neutral sector with practical, scalable solutions to cut greenhouse gas emissions with commercial focus.

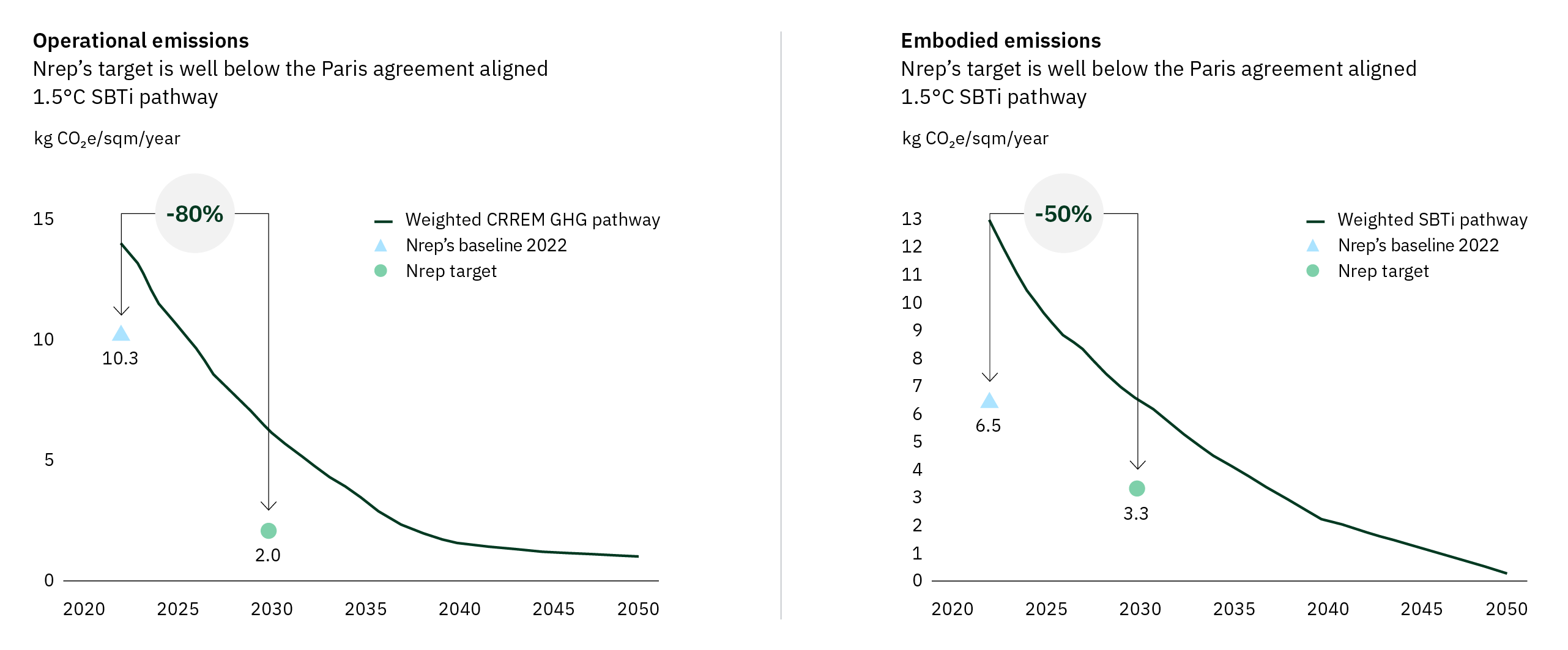

We have set decarbonization targets for the 2030 target year based on Science Based Target initiative’s Buildings Criteria. Nrep has committed to reducing in-use operational emission intensity by 80%. This target covers whole-building operational energy use and refrigerant leakage.

We were also among the first estate companies to set a near-term target for embodied carbon emissions. The commitment is to reduce upfront embodied emissions by 50% by 2030 compared to the 2022 baseline. You can discover more about 1.5°C alignment below.

You can discover more about 1.5°C alignment below.

The Science Based Targets commitment is a pathway for companies to reduce their greenhouse gas emissions by setting their targets in line with climate science goals. SBTi is aligned with the goals of the Paris Agreement, pursuing efforts to limit global warming to 1.5°C above pre-industrial levels.

We map out details in our Decarbonization Policy and progress in our annual Impact Report

SBTi targets with the current portfolio composition translated to kg CO2e/sqm/year

As part of Urban Partners, our yearly progress within ESG topics is addressed as part of the Urban Partners Impact Report.

This report showcases our collective efforts in making a meaningful and lasting impact on communities, the environment, and society at large.

The Earth Shots projects in logistics and residential explore new ways of building more sustainable buildings with significantly lower operational and embodied emissions. The name Earth Shots is derived from moonshot – an ambitious and ground-breaking project, which is undertaken without the assurance of short-term benefit.

The objective is to test innovative solutions which can help us understand and learn more about decarbonization in real estate, learnings from which can be applied in our wider portfolio.

Existing buildings are a large part of the Nrep portfolio, and the emissions performance of many of these can be improved.

A top-down estimate of Nrep’s current portfolio shows that to reach Nrep’s anticipated SBTi commitment, would require a significant investment to transform more than 300 assets. The direct benefit of brown-to-green investment, mainly lower energy bills, goes to the tenant, but a longer term view brings a different perspective.

Financing costs will most likely be lower due to EU taxonomy alignment, lenders’ focus on decarbonization and access to brown-to green funds. Greener buildings attract blue-chip tenants who are committed to lowering their CO2-emmissions and when it comes to sale, we have seen CO2-concious assets commanding a higher price.

We build real estate solutions based on customer-centric concepts, which solve problems and deliver value for residents. All Nrep solutions are different, because they address different problems and serve different needs. But at the heart of all our solutions is a combination of true customer insight and a clear concept that adds value – continuously insisting on seeing a user and a customer, rather than just a tenant.

Read more about solutions:

Flexible living for modern urbanites

Care homes that stimulate well-being

Homes for the modern lifestyle

Serviced community for all generations

Student housing with shared spaces

Offices to thrive in – for businesses and employees

Modern logistics facilities